Featured

Table of Contents

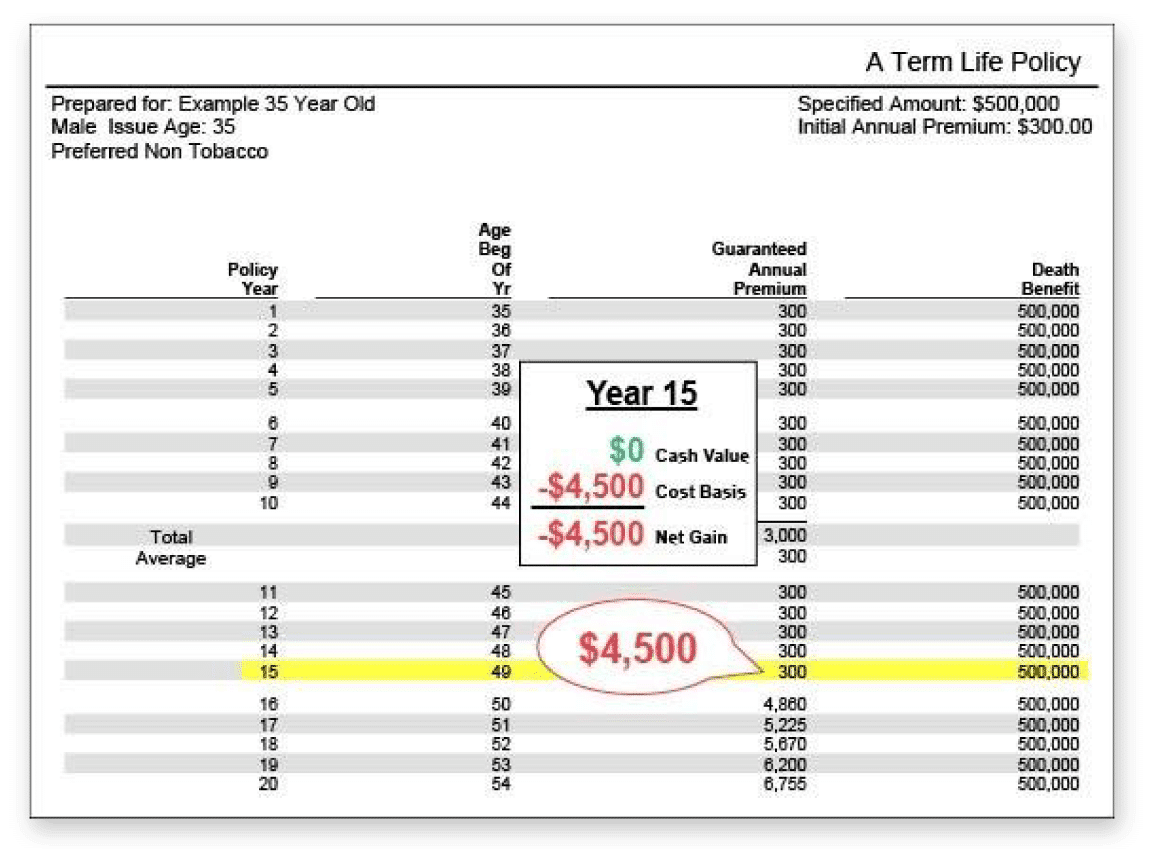

Term plans are additionally commonly level-premium, yet the overage amount will certainly remain the exact same and not expand. One of the most common terms are 10, 15, 20, and 30 years, based upon the needs of the policyholder. Level-premium insurance policy is a type of life insurance policy in which premiums remain the very same price throughout the term, while the amount of insurance coverage provided rises.

For a term plan, this implies for the length of the term (e.g. 20 or thirty years); and for a long-term plan, until the insured dies. Level-premium plans will commonly cost even more up front than annually-renewing life insurance policy plans with regards to just one year at a time. Over the long run, level-premium repayments are often extra economical.

They each seek a 30-year term with $1 million in insurance coverage. Jen gets an assured level-premium plan at around $42 each month, with a 30-year horizon, for a total amount of $500 annually. However Beth figures she may only need a prepare for three-to-five years or until complete payment of her present debts.

So in year 1, she pays $240 each year, 1 and about $500 by year five. In years 2 via five, Jen remains to pay $500 per month, and Beth has paid an average of simply $357 each year for the same $1 countless coverage. If Beth no much longer needs life insurance policy at year five, she will have saved a lot of money about what Jen paid.

What is Term Life Insurance With Accelerated Death Benefit? Discover the Facts?

Annually as Beth gets older, she faces ever-higher yearly costs. On the other hand, Jen will certainly continue to pay $500 each year. Life insurance companies have the ability to offer level-premium policies by essentially "over-charging" for the earlier years of the plan, collecting even more than what is required actuarially to cover the risk of the insured passing away throughout that very early duration.

Irreversible life insurance coverage creates cash worth that can be borrowed. Policy car loans accrue rate of interest and overdue policy finances and passion will decrease the survivor benefit and cash worth of the policy. The amount of cash money value available will normally depend on the type of permanent plan purchased, the quantity of insurance coverage bought, the size of time the policy has actually been in force and any type of outstanding policy car loans.

Disclosures This is a basic summary of coverage. A total declaration of protection is found just in the plan. For more details on protection, expenses, constraints, and renewability, or to get insurance coverage, contact your regional State Farm representative. Insurance coverage and/or connected motorcyclists and attributes may not be available in all states, and plan terms may vary by state.

Level term life insurance policy is the most uncomplicated method to get life cover. Because of this, it's likewise one of the most preferred. If the worst occurs and you pass away, you understand precisely what your enjoyed ones will receive. In this write-up, we'll explain what it is, exactly how it functions and why degree term might be best for you.

What is Short Term Life Insurance? How to Choose the Right Policy?

Term life insurance coverage is a sort of policy that lasts a details size of time, called the term. You pick the size of the policy term when you first obtain your life insurance policy. Maybe 5 years, twenty years and even a lot more. If you die throughout the pre-selected term (and you've kept up with your costs), your insurance provider will pay a lump amount to your nominated recipients.

Choose your term and your quantity of cover. You might need to answer some inquiries regarding your case history. Select the plan that's right for you - Level term life insurance definition. Now, all you need to do is pay your premiums. As it's level term, you recognize your costs will certainly stay the same throughout the term of the plan.

(However, you don't receive any cash back) 97% of term life insurance policy cases are paid by the insurance policy business - SourceLife insurance policy covers most scenarios of death, but there will certainly be some exclusions in the terms of the policy. Exemptions may consist of: Genetic or pre-existing conditions that you fell short to reveal at the begin of the policyAlcohol or medication abuseDeath while committing a crimeAccidents while taking part in harmful sportsSuicide (some policies exclude fatality by suicide for the initial year of the plan) You can add important health problem cover to your level term life insurance policy for an added cost.Critical disease cover pays a portion of your cover quantity if you are diagnosed with a major illness such as cancer cells, cardiac arrest or stroke.

After this, the policy ends and the surviving partner is no longer covered. Joint plans are typically much more inexpensive than solitary life insurance policy plans.

What Is Direct Term Life Insurance Meaning? The Complete Overview?

This safeguards the buying power of your cover quantity versus inflationLife cover is a wonderful point to have because it supplies economic defense for your dependents if the most awful happens and you die. Your liked ones can additionally utilize your life insurance coverage payment to spend for your funeral. Whatever they choose to do, it's fantastic assurance for you.

Nonetheless, degree term cover is wonderful for fulfilling everyday living costs such as house bills. You can additionally utilize your life insurance policy advantage to cover your interest-only home loan, repayment mortgage, institution fees or any various other debts or continuous settlements. On the various other hand, there are some disadvantages to level cover, compared to other kinds of life plan.

Term life insurance policy is a cost effective and straightforward option for many individuals. You pay costs monthly and the protection lasts for the term size, which can be 10, 15, 20, 25 or three decades. 10-year level term life insurance. But what takes place to your costs as you age depends on the sort of term life insurance policy coverage you purchase.

An Introduction to Life Insurance

As long as you remain to pay your insurance coverage premiums every month, you'll pay the very same price throughout the entire term length which, for many term policies, is usually 10, 15, 20, 25 or 30 years. When the term finishes, you can either choose to finish your life insurance protection or restore your life insurance policy policy, generally at a higher price.

A 35-year-old female in excellent health and wellness can acquire a 30-year, $500,000 Sanctuary Term policy, provided by MassMutual beginning at $29.15 per month. Over the next thirty years, while the policy is in place, the cost of the insurance coverage will not change over the term duration - Level term life insurance policy. Let's admit it, the majority of us don't like for our bills to expand over time

Your level term price is determined by a variety of variables, a lot of which are associated with your age and wellness. Various other variables include your certain term policy, insurance policy supplier, benefit quantity or payment. Throughout the life insurance policy application procedure, you'll answer inquiries concerning your health history, including any type of pre-existing problems like a crucial health problem.

Latest Posts

Final Expense Benefit

Instant Insurance Life Online Quote

Instant Life Insurance Cover